20-year financial veteran Paul Murphy shares the best debt repayment calculators. Use these to get a sense of your financial situation and to build a smarter debt repayment plan.

If you want to find the best debt repayment calculators, then you’ll want to bookmark this guide.

I’ve worked in the financial services industry for 20+ years. I’ve personally tested and reviewed over 200 debt repayment calculators.

4 Pillars wasn’t paid or compensated to mention these tools. I think they are all excellent calculators and I created this list as a resource for 4 Pillars’ clients.

In this guide, you’ll find:

- Debt repayment calculators

- Credit card interest calculators

- Debt snowball calculators

- Amortization calculators

- Student loan calculators

- Debt consolidation calculators

SIMPLE DEBT REPAYMENT CALCULATORS

Credit Karma

The best debt repayment calculator I’ve found is from Credit Karma. You can enter a desired payoff time frame (such as trying to get out of debt in 12 months). That way, you can see if your debt repayment plan is realistic.

The calculator also generates helpful charts, showing you how much interest you’ll pay. For example, you can play with your credit card debt numbers. Did you know that if you owe $5000 on a credit card and pay them $100 per month that the total interest you’d pay would be $4,311! That means it would cost you $9,311 in total to borrow that $5,000.

Use the debt repayment calculator here

Credit Karma (amortization calculator)

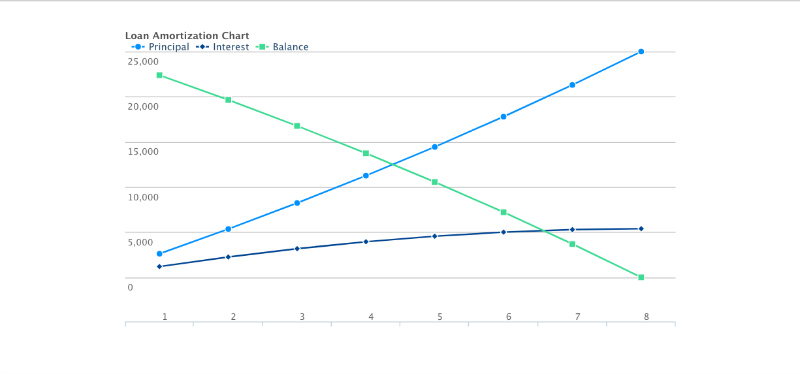

Credit Karma also has a fantastically simple loan amortization calculator. As you might know, amortization means the time frame it takes to pay off your loan. The longer the time frame, the more you’ll pay in interest.

This is a good tool for calculating the real cost of car loans. Or for seeing how much that loan from Best Buy will really cost you if you put off too long.

Using amortization calculators can really open your eyes to the true costs of financing. A car loan of $25,000, for example, would cost you a total of $30,384. That assumes a five percent interest rate for eight years. Rates can be considerably higher than five percent for car financing with bruised credit.

You can also use an amortization calculator to see how much your mortgage will cost you. A $500,000 home actually costs $791,755. That assumes an interest rate of 4 percent (as rates will go up in our lifetime) over 25 years.

Use the amortization calculator here

CNN Money

If you want to create a debt repayment plan for multiple loans, try CNN’s debt-free calculator. Add multiple rows of debt—such as your car loan, mortgage, line of credit and so on—and see the total picture of your finances.

The best feature is that you’ll get an exact date for when you’ll be free of debt. Print this out and put it on your fridge, helping your family commit to your repayment plan.

Use CNN’s debt-free calculator here

DEBT REPAYMENT WORKSHEETS

Gail Vaz-Oxlade

At 4 Pillars, we love Gail’s honesty when it comes to debt. She doesn’t let you get away with anything! Gail offers a free debt repayment worksheet. Enter all of your individual debts and interest rates. The best part about this debt repayment worksheet is that you can print it out and put it on your fridge.

Use Gail Vaz-Oxlade’s repayment worksheet

STUDENT LOAN REPAYMENT CALCULATORS

NerdWallet

In Canada, student loans are easy to get and equally easy to procrastinate paying off. But the longer you stick with those minimum payments, the more you’ll pay. This might not seem like a big deal in your twenties. But it can have long-term opportunity costs for retirement savings, buying your first home, and investing.

If you’re looking for a student loan calculator, NerdWallet has one of the best ones out there. Plug your student loan information into the calculator and you’ll get lots of ideas to pay off your student loan debt faster.

Use NerdWallet’s student loan calculator here

DEBT SNOWBALL CALCULATORS

Calculator.org

A popular debt repayment method is called the snowball method. I believe it was coined by Dave Ramsey.

This debt repayment method allows you to maintain your credit score by keeping current on all minimum payments and allocating all additional available funds to either the smallest debt or the debt with the highest interest.

You accelerate your debt payoff by using the “rollover” method. As soon as the first debt is paid off you allocate the new additional payment amount to pay down the next debt even faster. You continue the process until all debts are paid off.

The cool part about this debt snowball calculator is that it allows you to create a payment schedule, helping to keep you on track.

Use the debt snowball calculator

Yetti

Start a debt snowball fight with this fun calculator. It operates on the same principles as the debt snowball calculator above. But I like the fun design and it’s easy to use.

For example, you might decide to attack loans with the highest interest rates first. Or, if your debt seems like a giant mountain to climb, you might start knocking off some small loans to give you a motivational boost. You can read a quick guide to the debt snowball principles here.

Use the Yetti debt snowball calculator here

MINIMUM PAYMENT CALCULATOR

Calculators.org

I mentioned Calculators.org earlier. But they also have a simple minimum payment calculator. Use this calculator figure out how much total interest you’ll pay if you only make the minimum payment requested by your credit card.

Use the minimum payment calculator

EXTRA MORTGAGE PAYMENT CALCULATORS

Mortgage-X

Ever wonder what difference an extra mortgage payment makes? This simple mortgage payment calculator from Mortgage-X will tell you. Just follow the steps. You can add filters such as monthly or annual payments, as well as adjust your payment amount.

Use the extra mortgage payment tool

DEBT REPAYMENT CALCULATOR EXCEL

Vertex

If you use Excel and would prefer to calculate your debt repayment in a spreadsheet, Vertex has a pretty good one. The site has a video to show you how to use the Excel tool.

Download the Excel debt repayment calculator

CREDIT CARD INTEREST CALCULATORS

Financial Consumer Agency of Canada

Offered by the Canadian Government, this is a simple credit card interest calculator. It shows you how much extra money you’ll pay in interest on your credit card debt.

The nice thing about this calculator is you can see how much money you can save by paying more than the minimum payment with lump sums or fixed amounts.

Use the Government of Canada’s debt repayment calculator

Superbrokers

This mortgage company offers a really accurate option to gauge exactly how much interest you’ll pay in credit card debt. You can input extra factors like new card introductory rates, annual fees, multiple credit cards, and balance transfer fees.

You can model different practical options including whether it’s worth it to transfer a balance once you take into account balance transfer fees, or you can see what happens when you pay down one card faster than the other.

Use the credit card interest calculator

Did using these debt calculators make things look hopeless?

All the debt calculators mentioned are excellent tools to help you repay manageable debt levels and to help you plan and understand the true cost of making a purchase on credit and carrying debt.

But sometimes, debt calculators can present a bleak future. You might have tried to budget, explored different options to pay down your debt, and things still have become unmanageable.

The reality is that debt has a huge influence over the quality and happiness in our lives. The time we spend thinking about money is all consuming. We think about how to earn more money. We worry about our future finances. We think about how to reduce debt, increase our savings, and build new assets.

At 4 Pillars, we help families in debt and see the impact that poor finances have on people. Without stable finances, it becomes hard to enjoy life or live in the present moment.

Having sufficient money means we can comfortably provide for our families, create a long-term financial roadmap and spend time enjoying recreational activities.

Money determines where we live, which school our children attend and which social circle we move in. Money is also responsible for our attitudes, our confidence in certain situations, and our relationships with family and friends.

For most of us, it is rare that we will go through life without experiencing any type of money troubles. The older we get the more responsibilities we have. And the greater the financial challenges become.

There are a number of life events and circumstances that can generate an enormous amount of financial stress, and lead us to incur significant and unwanted debt. It may be as superficial as trying to keep up a lifestyle beyond what our income allows, or as life-altering as a failed business, divorce, or serious illness.

Debt retains a sense of stigma which leaves people feeling alone and afraid to address their problems, with often damaging results. Debt is often hidden, embarrassing, and something we try not to speak about.

Making the first call to deal with debt can be the hardest. We hear from our clients how they wished they had made the call earlier. Life will continue to move forward and with a solid debt repayment plan in place to deal with overwhelming debt the stress will be removed. You will begin to take back financial control of your life.

The phone will ring and you will answer it and you will open the mail without fear. You will have made meaningful, long-lasting changes to your life and the hard lessons will slowly turn into positive life situations. You will understand more about your finances and credit than you ever did before.

This is the exact story that one 4 Pillars client told us. This man, in his 50s, lost his business. And he shared how he went from deep into debt to finding his way back to security and happiness. Read his story, in his own words, here.

Debt will always be with us in some capacity and is part of life, it should not be unspoken and should not be feared but it should always be understood.

If you want to speak to a 4 Pillars expert in your city, you should do three things.

First, read reviews of 4 Pillars. We’ve collected 1000+ 4 Pillars reviews here. We’re also listed on Trustpilot, an independent review site (like Tripadvisor or Yelp). We have a 5-star rating with 600+ reviews from Canadians.

Second, sign-up for our email debt boot camp. It’s at the top and bottom of this page. You’ll get essential education about your debt options in Canada delivered in short weekly lessons via email.

Finally, contact one of our offices. We’re in every Canadian city and town. You can see a list of 4 Pillars offices here. A local expert will review your situation, give you information, and show you the next steps.

Contact your local 4 Pillars office